Pareidolia

Bulls and Bears suffer from the same affliction — pareidolia. That is, seeing something, typically a pattern or image, that isn’t there.

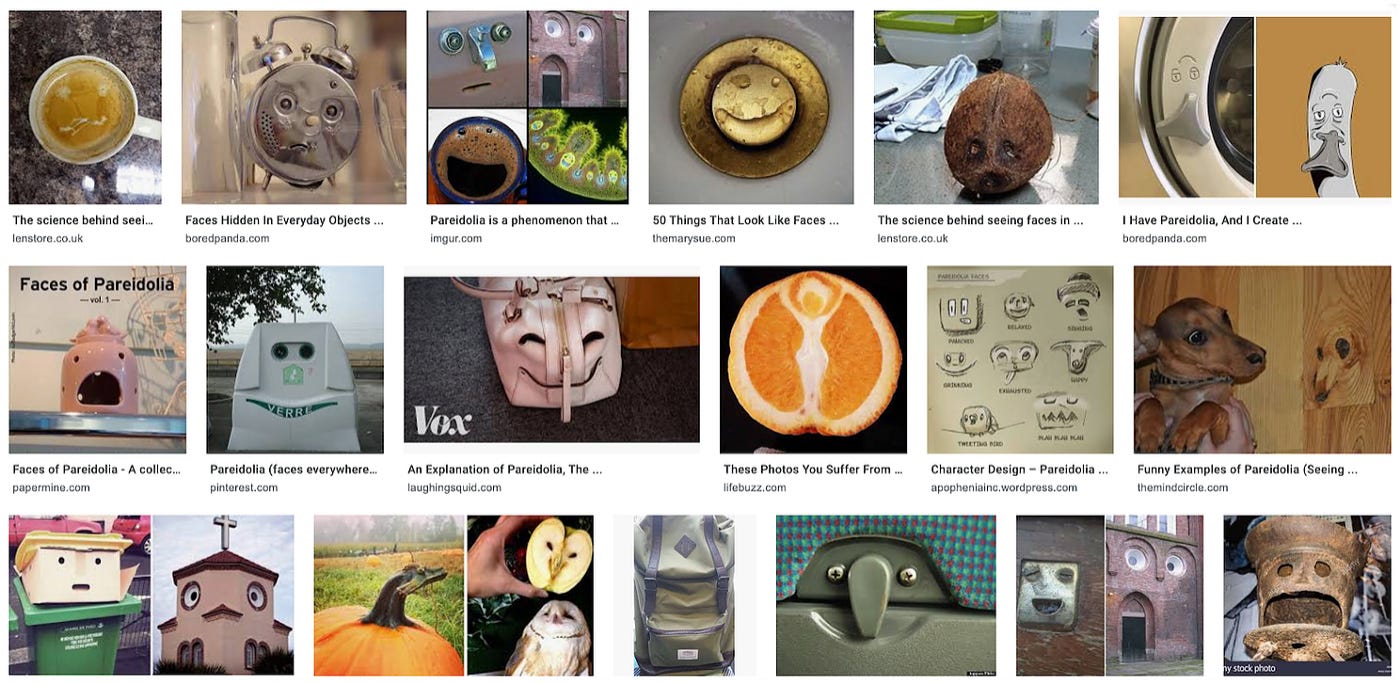

Examples of pareidolia:

Bulls see the current equities chart pattern as one that looks like a previous uptrend. From this, they forecast higher prices. Bears, as you can imagine, see the opposite. People see what they want to see. Feelings and opinions direct their investing decisions, not logic or the trend.

Today, Bulls think we’re near a bottom. Bears see a larger bear market on the horizon. Who’s right? Who knows. But you can bet your ass that both sides will present very convincing arguments. They’ll dig deep into their cognitive dissonance and behavioral biases to produce skewed data and past lookalike charts that “predict” the market’s next move.

Absent consistent definitions for “uptrend” and “downtrend” as well as rules on when to buy and sell, we’ll always be subject to pareidolia. Whether we realize it or not, we’ll be influenced by others’ opinions, our personal financial situation and how we handle bedrock feelings such as boredom, greed and impatience.

We must strive for consistency and discipline. Not pie-in-the-sky ideas about how much money we’re going to make on this “sure thing” we know is going to happen. We don’t know anything. Spend enough time in the markets and on this planet, you realize no one knows what’s coming next. Playing around in fantasy-land superimposing stock charts from the 1930’s on today’s markets only gets you in trouble.

Past patterns seldom repeat. Don’t let pareidolia seduce you into holding onto losers because you think you know what’s coming next. You don’t. You never will. Observe what is and respect the trend.