This is a rather long post, but I think an important one especially as bubbles have become the norm in financial markets. My intention is simply to provide some simple and effective tools, that I use in my own trading, for navigating through extremely volatile markets — especially those that excite emotions and get us to make poor decisions.

View the pdf version on my website here.

Introduction

Bubbles seduce. They fan the flames of our innate greed and envy. They lure us in with the hope of a quick score. They also give us something to do. They medicate our boredom and spice up the mundaneness of everyday life. Ultimately, though, only a few get rich while many are left worse off.

Over the past few years, we’ve seen a number of bubbles across multiple asset classes. From green energy to crypto to AI to meme stocks — even cocoa prices. As our current economic system matures, booms and busts are becoming more common and intense. Explaining why is not my focus in this paper. Instead, I’d like to share a few ways to help you to keep your money safe when a bubble rolls our way.

Bubbles make for great conversation, but typically the punchline ends with “I lost money”. People routinely find themselves getting caught up taking risks they cannot afford. They become entranced by the thought of life-changing profits that they disregard basic risk management. They fall under the spell of sycophants telling them what they want to hear. They gobble it up and wind up getting in over their head.

Most of us stumble into bubbles after hearing about a high-flying stock in the financial media, at the office or on the golf course. All too often, though, by the time they get wind of it, the majority of the opportunity has already passed. The easy money has been made. All too often, they get in near the top without any tactics to protect capital on the downside. A recipe for disaster.

We need a systematic way of detecting bubbles and acting on them with proper risk control. One thing we cannot do, however, is predict when bubbles (or trends, in general) will occur. All we can do is measure and manage. And if we can measure it, we can manage it.

The tactics I introduce in this paper are demonstrated on recent bubbles. Some have already fallen -80-90%, but some are still close to their highs (e.g. Cocoa, NVDA, SMCI). So, you’ll be able to see the tactics in action as well as consider using them for the next bubbles (or your investments, in general).

And let me reiterate: I do not provide any tools or advice on how to predict bubbles. This paper is about helping you protect your money in the event you find yourself holding an extremely volatile investment.

What is a Bubble?

Institutional definitions are a bit fuzzy, but they typically include language about economic cycles, intrinsic value and other fundamentals. Many people, however, agree on the notion of “you know it when you see it”.

Investopedia's definition:

“A bubble is an economic cycle that is characterized by the rapid escalation of market value, particularly in the price of assets. This fast inflation is followed by a quick decrease in value, or a contraction, that is sometimes referred to as a "crash" or a "bubble burst.”

When talking about bubbles, people tend to discuss the story behind it — the fundamental reasons why its happening, why it’ll keep going up, why it’ll collapse or how its pattern looks similar to a previous one. All of this is just talk though. Knowing the story does not help us how to actually trade it. Knowing when to enter, when to exit or how big of a position to take — this is what really matters.

So, we’re going to bypass all of the fundamental fuzzy talk and define a bubble mathematically. This allows us to treat all bubbles the same regardless of fundamentals, the story, our expertise and most importantly our feelings and (biased) views. It also allows us to test the effectiveness of our techniques across all bubbles, which if they work, will give us the confidence we need to execute perfectly when the next one rolls our way.

Our Definition

When the daily price closes 100% above the 300-day simple moving average

This is a simple definition we can all understand. No room for interpretation. We don’t need to have expertise in the asset nor do we even need an opinion. If the price ever closes 100% above its 300-day moving average, we’re in a bubble. That’s it.

Is it the “best” definition? That’s irrelevant for the purposes of this paper. We’re simply trying to come up something useful to help us protect our money when prices (and our emotions) are running wild.

Plus, the “best” definition of the past is unlikely to deliver the best results in the future. And no one can predict what the best definition or tactics will be, so I think it’s better to focus on something that’s pretty good and useful instead of “the best”.

Before we get to the recent examples and tactics, let’s dig in a little more about the nature of bubbles.

Bubbles are Everywhere, Not Just Financial Markets

The boom-bust pattern is not specific to financial markets, but the natural world. Parabolic patterns regularly occur in nature and society. Examples include thunderstorm formations, population growth, cancer, debt accumulation, etc. They’re everywhere.

Why Do Financial Bubbles Occur?

There are a few theories. One is that they simply don’t (or can’t) occur because investors are rational and would never act irrationally when it comes to making investing decisions. Another one is that “animal spirits” are responsible. The Austrian School of Economics states that the availability of money (credit) directly contributes to the magnitude and frequency of bubbles.

Vernon Smith, the famous Nobel Prize winner, even found his subjects creating bubbles in his famous 1988 experiment. And what increased the magnitude of the bubbles and corresponding crashes? Giving them more money to trade. We are seeing this play out in real-time.

Over time, we generally get an increase in money supply and availability of credit. Higher prices for many goods and services, especially in areas that lack competition, is usually a symptom. Eventually the money concentrates in specific asset-classes or businesses, resulting in bubbles.

As bubbles become more frequent, more people become interested in speculation as a career choice. Today, I believe this speculative class is further exasperating bubbles in the markets. Naturally as bubbles pop, and enough people have experienced significant financial pain, they rethink reckless speculation as a valid career choice and become motivated to pursue more productive forms of work.

Ed Seykota, in his book Govopoly in the 39th Day, suggests that the buying and selling pressure of both fundamental traders and trend-followers creates trends, which can evolve into bubbles when moral hazard is present. To quote Ed, “Moral hazard describes a situation in which people take larger risks than usual, due to easy money or lack of consequences for risk taking.” Again, I think we’re seeing this across markets today.

How Bubbles Work, According to Ed

What happens if moral hazard remains in the system?

Will Bubbles Continue Happening?

I believe so. People love buying a bargain and despise missing out on opportunity. These two simple, yet very emotionally complex, behaviors will persist in our DNA for a long long time. Maybe forever.

Emotions provide feedback. They have positive intentions. They help keep us alive. Thinking that we can ignore emotions completely and, instead, rely solely on logic is, well, illogical.

Our human condition will continue producing booms and busts. Vernon Smith’s experiment produced booms and busts without real money involved. Our behavior is that deeply ingrained. We can’t help it even when there’s nothing at stake.

I’m preparing for more bubbles.

Are Bubbles Becoming More Common?

I went back to count all of the instances each year where our bubble definition (pg. 2) had been met. The universe of markets I included is located in the disclosures on page 16. Over the past ~50 years, we’re seeing a gradual increase in the number of bubbles. The surge in bubbles from 2004-2010 makes sense given the easy money policies in place. Same goes for the recent 2020-22 period.

Recent Bubbles

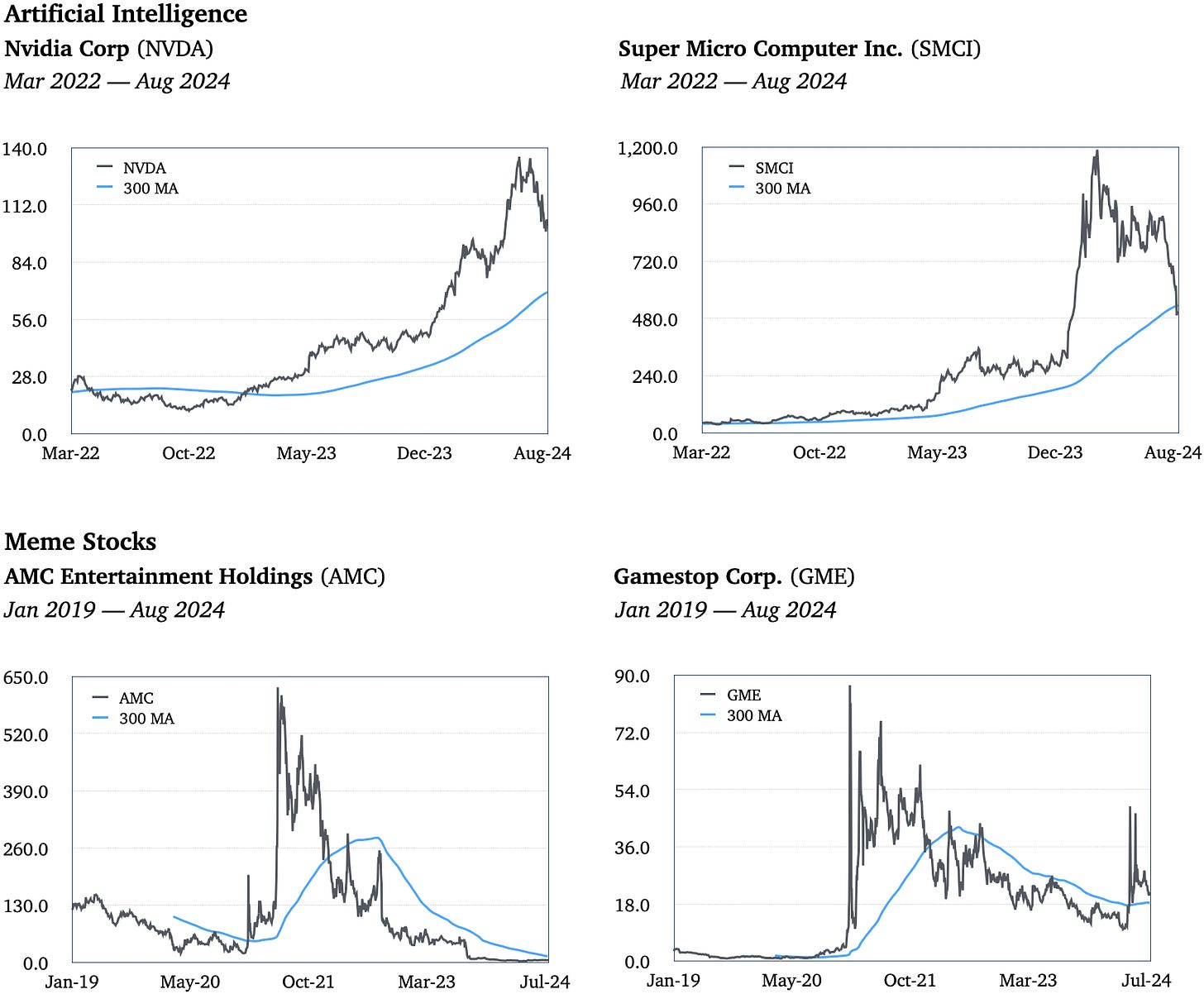

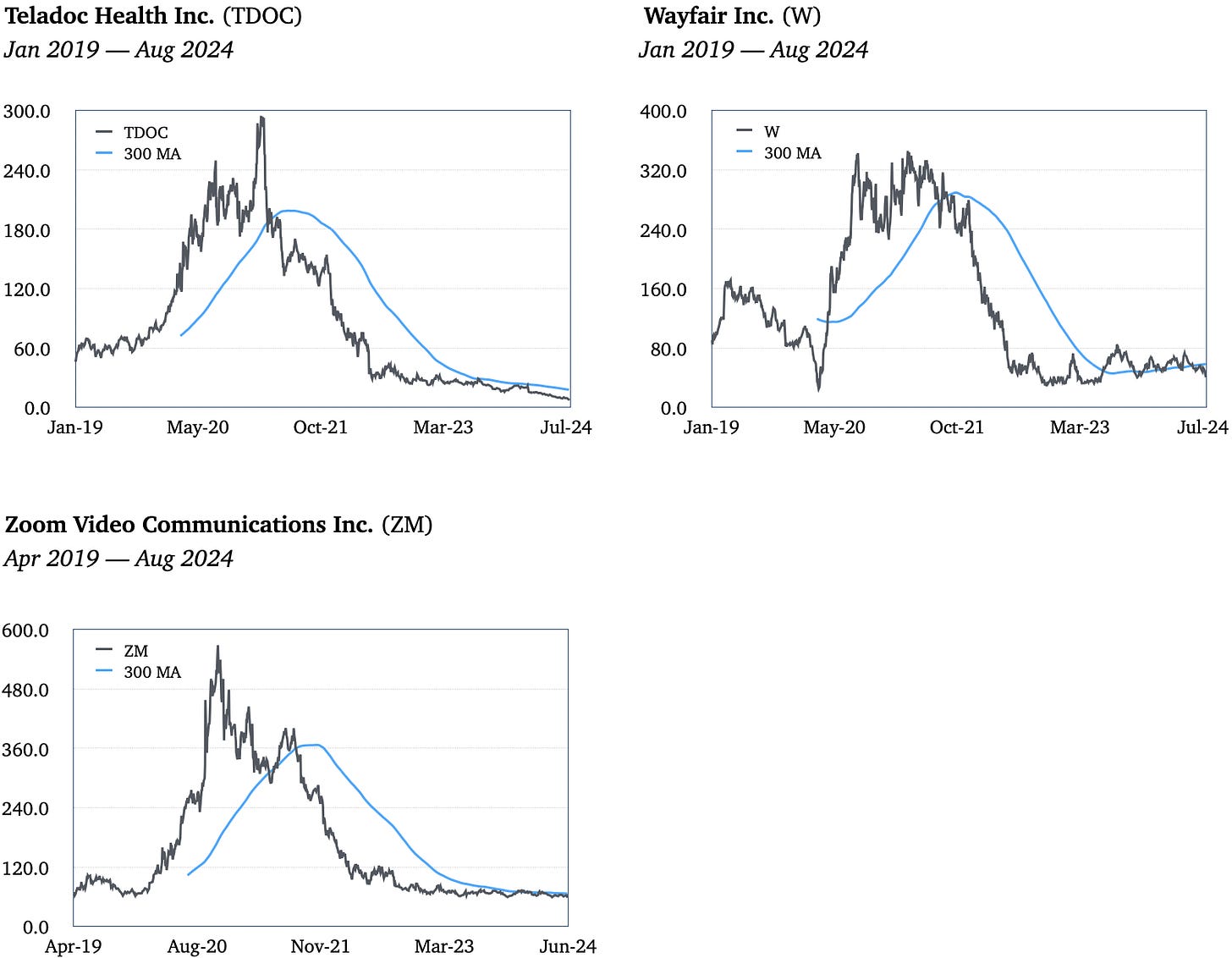

In the commodity markets, look no further than the 2023-24 chart of U.S. and London Cocoa. In the equity markets, the AI-craze is powering stocks such as Nvidia (NVDA) and Super Micro Computer (SMCI).

Looking further back to a few years ago, we saw bubbles in Clean Energy, meme and COVID-19/Work-From-Home stocks.

All slightly different stories with slightly different patterns, but the same components powering all of them — easy money, moral hazard and emotional human beings.

Zooming out, the charts look more or less the same. Some took longer to develop while others were more short-lived, but all of them produced the classic parabola pattern.

In this paper, we only care about long-term bubbles. The ones that captivate the masses for an extended period of time. Those that become part of the culture and topic of conversation in the financial media, at barbecues and happy hour. We don’t care about small-cap biotech stocks, for example, that pop and drop on recent news about one of their drugs.

So, let’s have a look at them.

Don’t Worry About Predicting

Before we get to the tactics, I’d like hammer home the idea of predicting. It deserves its own section. It’s that important.

No one can consistently predict the direction of any financial market. If one does make an accurate prediction, plain dumb luck or inside information is likely the reason. And, contrary to what you might believe, we do not need to be able to predict in order to make money in the markets.

The tactics in the following section will help prove this to you.

When you enter a trade, you do not know what will happen next. You have no way of knowing if prices will continue running up or if the market has already topped. The focus must be on what you can control (i.e. how much you have at risk). Take a minute to contemplate the following: 1) How much money do I have at risk?; 2) Is this amount within my budget and tolerance?; and 3) What will tell me it’s time to exit this position?

The focus must always be on what we can control, namely how much money we put at risk and not on things outside of our control such as the direction of the markets. It feels good to predict, which is why so many people do it, but I’d rather have my money than feel good. Just sayin’.

The Tactics

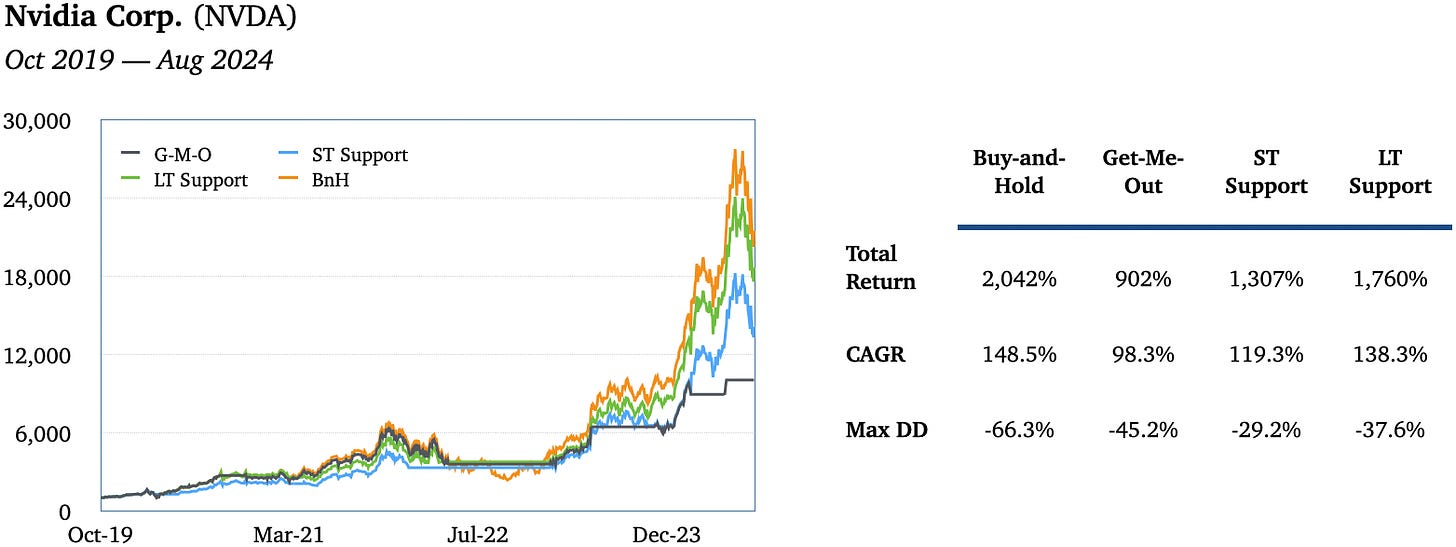

OK Let’s get to it. Below are a few different ways to manage risk during bubbles. The first option exits immediately when a bubble occurs. You may notice this option disobeys our non-predicting mantra. This is done on purpose for a reason that will become evident when we look at the results later. The other two options are simple and effective trend-following trailing stop rules.

Three options:

"Get Me Out” — When our definition of a bubble is met (pg. 2), exit the entire position at the end of the day.

Short-Term Support — Exit when prices close below the lowest closing price of the past 3-months.

Long-Term Support — Exit when prices close below the lowest closing price of the past 6-months.

Now, what do we do when supports breaks (triggering an exit) only to see prices shoot back up to the highs? On the NVDA chart on the previous page, the trailing exits were hit a few times then prices rallied to new highs again. What do we do? Do we get back in?

Very good question. We need a rule for entering and re-entering.

Initial Entry Rule: Buy when the price closes above the highest closing high over the past 200-days.

Re-Entry Rule: If/when the price triggers an exit to any of our three options, we re-enter when prices close above the 200-day closing high.

**If this seems like an awfully long time to get back in, whereby giving up a lot of potential gain, well, you’re right. But, believe it or not, buying high counterintuitively is a good idea. Check out Meb Faber’s paper on this — www.cambriainvestments.com/wp-content/uploads/2024/02/Cambria-AllTimeHighs.pdf

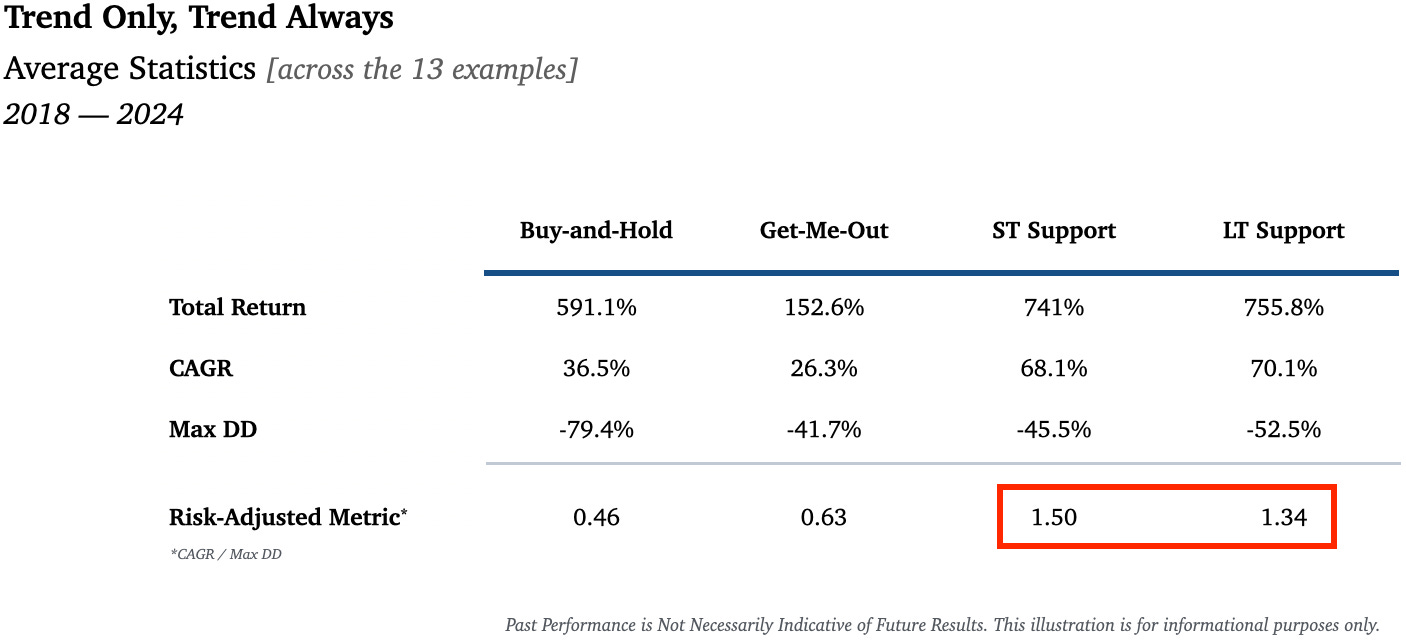

Performance Comparison

Let’s see how the tactics faired on all of the bubbles compared to a simple buy and hold approach.

The Numbers

No surprise that prioritizing the trend over the the story, fundamentals and your own biased views helps improve the performance.

Notice also that the feel-good Get-Me-Out option performs the worst. Herein lies the danger of cutting a winning position. Booking profits just because it’s in a “bubble” or whatever other reason you come up with may feel good because you avoid some of the reversal, but you also severely limit your upside gain.

Remember, predicting is foolish specifically for this reason. Large trends are hard to come by, so when you’re fortunate enough to get on board a good trend, don’t limit the upside.

Cap the downside and let it ride.

Final Words

Bubbles excite emotions. This inhibits our ability to observe, adapt and protect our money. Bubbles destroy wealth for most participants. Utilizing trend-following tactics can allow you to participate in major trends with the added benefit of limiting downside risk.

Thank you for making it through this paper. Please feel free to send me any questions or criticisms to michael@melissinostrading.com. Best of luck to you in your trading.

I don’t trust myself to follow the rules of trend following scrupulously so I’m hiring CTAs to do it for me. I own some long-only assets I don’t trade (except to rebalance), but outside of core equity positions, gold, and cash, trend following is time tested and effective for the rest of the portfolio.